Home » Business Valuation

Business Valuation

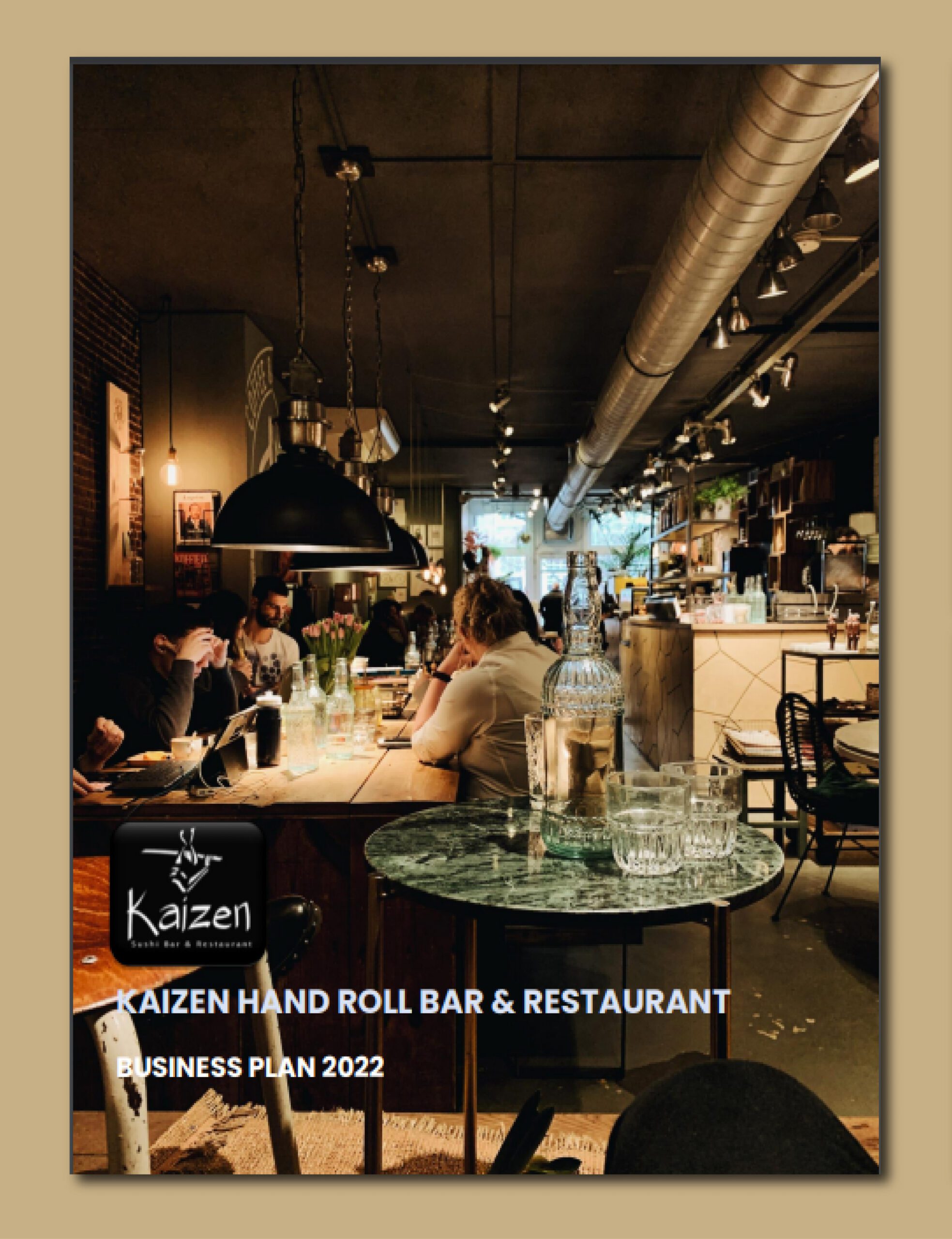

Overview

A business valuation, also known as a company valuation, is the process of determining a company’s economic value. During the valuation process, all aspects of a business are examined to determine its value as well as the value of its departments or units.

Why do we need a business valuation?

Companies need business valuation to determine the current market value of the business, which helps in decision-making regarding mergers and acquisitions, fundraising and capital investments. An accurate business valuation attracts investors, lenders, who are interested in the company’s growth potential

Review some modes for valuation

- Market Capitalization

- Times Revenue Method

- Earnings Multiplier

- Discounted Cash Flow (DCF) Method

- Book Value

- Liquidation Value

Why Ideate Business plans?

We tailor the scope of our commercial enterprise valuations to our consumer’s precise desires and the cause of the engagement. While suitable, our valuation document offers a top-level view of the enterprise, industry, and economic system; discusses fee drivers; outlines the evaluation accomplished, along with the inputs and assumptions; and contains targeted reveals that assist our valuation conclusion. The valuation evaluation is sound and the file is defensible, and if challenged, we offer our clients additional guidance.

Few of our prestigious clients

We have collaborated with numerous successful entrepreneurs and businesses across diverse industries.

Previous

Next

Do you find yourself struggling with valuing your business? Let our team of professionals assist you in obtaining the guidance you need!

Our team of experts can provide valuable assistance in the decision-making process:

Develop practical and impartial valuation models using predictive analysis while accounting for uncertainty.

Assess all possible influences of each driver on the company's value.

Make informed strategic decisions based on the analysis and evaluation performed.

Conduct a thorough analysis of the company's financial statements and historical performance to determine its current and potential value.

Engage in a dialogue with stakeholders to gain a comprehensive understanding of the company's unique strengths, weaknesses, and opportunities for improvement.

Extensive experience

Our team members combinedly carry 7 securities licenses including Series 79, 7, 24, 63, 66, 22, 4, and SIE. Our expertise in M&A and investment banking along with our combined team experience of 50+ years makes us one of the best in business.

If you're passionate about your business, Let us help you out!

Different businesses have different standards for what should be included in a business plan.

Our team of expert business planners will create a custom plan tailored specifically to your business.