Introduction

Understanding pre-money and post-money valuations is crucial for startup financing, guiding decisions in fundraising, growth plans, and investor relations. Investors use these valuations to assess potential returns and risks, determining their equity stake and potential ROI. They ensure they’re not overpaying while evaluating the startup’s viability and growth potential, considering factors like financial stability, risks, and market trends.

Delving deeper into these concepts, we’ll also explore why hiring a financial modeling consultant is essential for accurate valuations (pre- and post-money) and maximizing funding opportunities.

Demystifying Pre-Money and Post-Money Valuations

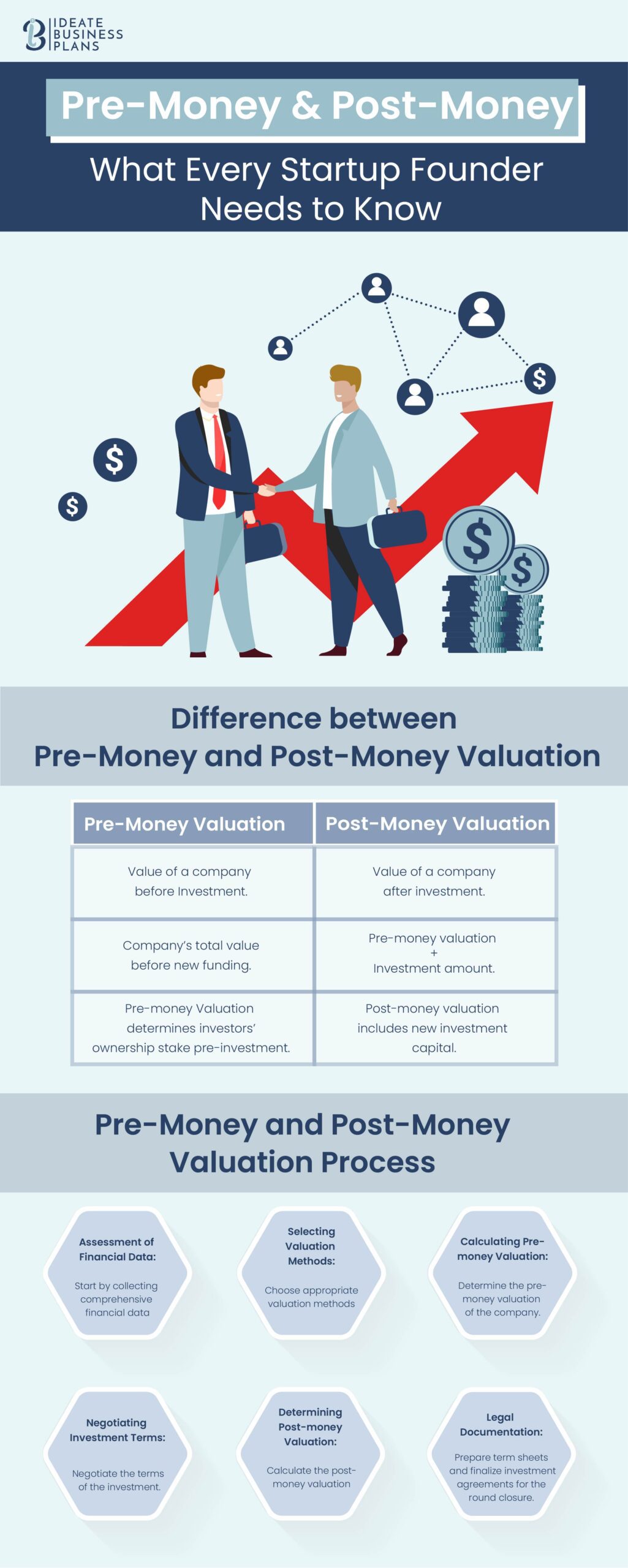

- Pre-Money Valuation: A startup calculates its pre-money valuation before seeking external funding, which signifies its worth before any investment inflow. This figure serves as the baseline for investors, indicating the company’s perceived value before any capital injection. For instance, if a startup determines its pre-money valuation to be $2.4 million, potential investors view the company’s worth as $2.4 million before committing any funds.

- Post-Money Valuation: After securing external funding, the company’s value typically experiences a surge, leading to the establishment of the post-money valuation. This valuation incorporates the injected investment amount along with the pre-money valuation. For instance, if a startup manages to secure a $1.5 million investment on a pre-money valuation of $2.4 million, the resultant post-money valuation would sum up to $3.9 million ($2.4 million + $1.5 million). This demonstrates how external funding can significantly augment a company’s perceived value in the market, paving the way for further growth and expansion opportunities.

Crunching the Numbers: Calculating Valuations

- Pre-Money Valuation Calculation: One common method to calculate pre-money valuation is the Scorecard Valuation Method. This approach involves evaluating the startup’s performance metrics against industry benchmarks and assigning scores to various aspects such as team, market potential, and traction. For example, let’s consider a startup that scores 80 out of 100 based on its team expertise, market size, and early customer traction. If the average valuation of similar startups in the industry is $3 million, then the pre-money valuation would be calculated as follows:

Pre-Money Valuation = (Score / Benchmark Score) * Benchmark Valuation

= (80 / 100) * $3,000,000

= 0.8 * $3,000,000

= $2,400,000

In addition to the Scorecard Valuation Method, other approaches such as the market multiples method, risk factor summation method, and discounted cash flow (DCF) method are also used to determine pre-money valuation. These methods offer different perspectives and considerations, allowing startups and investors to assess valuation from multiple angles and make more informed decisions.

- Post-Money Valuation Calculation: After securing external funding, the company’s value experiences an uplift. Let’s continue with the example of our startup, which arrived at a pre-money valuation of $2.4 million using the Scorecard Valuation Method. Now, if this startup secures a $1.5 million investment from investors, we can calculate the post-money valuation.

Post-Money Valuation = Pre-Money Valuation + Investment Amount

= $2.4 million + $1.5 million

= $3.9 million

In this scenario, the post-money valuation of the startup would be $3.9 million, reflecting the added value brought in by the investment. This calculation demonstrates how funding injections alter a company’s overall valuation, marking a significant milestone in its growth journey.

Pre-Money and Post-Money SAFEs

A Simple Agreement for Future Equity (SAFE) is a deal between startup founders and investors. The key difference between pre-money and post-money SAFEs lies in the “Valuation cap,” which determines the highest price for converting a SAFE into company shares.

With pre-money SAFEs, the company’s value doesn’t include the shares from converting SAFEs. In contrast, post-money SAFEs include these shares. Pre-money SAFEs calculate the price per share based solely on the company’s value before adding new shares. This might mean earlier investors own less of the company with each new investment.

For example, if a startup with a pre-money valuation of $2.4 million raises $1.5 million through a SAFE, investors would pay $1 per share. However, if the post-money valuation becomes $3.9 million after the funding, the price per share decreases to $0.83. This shows how the valuation cap affects the conversion price per share.

Post-money SAFEs ensure shareholders, not new investors, cover the cost of ownership changes. Pre-money SAFEs allow startups to get funding before setting a company value. For instance, if a startup’s value is $2.4 million before raising $1.5 million, it might become worth $3.9 million after, a 62.5% increase. Post-money SAFEs ensure new investments are covered by shareholders, potentially reducing existing shareholders’ ownership.

Determining Conversion Price Per Share in SAFE Agreements

In SAFE agreements, the valuation cap sets the maximum price for converting a convertible security into equity. For example, if a startup sets a pre-money valuation cap of $2 million and later raises $1 million in funding, resulting in a post-money valuation of $3 million, investors will pay around $0.67 per share when converting their SAFE into equity. This mechanism ensures fairness and transparency, benefiting both investors and startup founders while preserving the company’s ownership structure.

How Pre-Money and Post-Money Valuations Affect the Ownership Percentage of Current Stockholders

Pre-money and post-money valuations can significantly impact the ownership percentage of current stockholders. When a startup raises funds, it issues new shares, which dilutes the ownership percentage of existing stockholders. The degree of dilution depends on the startup’s valuation and the investment’s size.

Pre and post-money valuations affect ownership percentage. If a startup has a pre-money valuation of $1 million and an investor invests $100,000, the post-money valuation becomes $1.1 million and the existing stockholder’s ownership percentage decreases from 100% to 90.91%. Similarly, if the startup has a post-money valuation of $1.1 million and an investor invests the same amount, the existing stockholder’s ownership percentage decreases from 100% to 50%. Higher valuations result in lower ownership percentages for existing stockholders because more shares need to be issued to raise the same amount of funds, which dilutes their ownership percentage. Therefore, startups should carefully consider their valuation and investment size to minimize dilution.

In summary, pre-money and post-money valuations can significantly impact the ownership percentage of current stockholders. A higher valuation results in a lower ownership percentage for existing stockholders, while a lower valuation results in a higher ownership percentage. Startup founders and stockholders should consider the valuation and investment size when raising funds to minimize dilution and maintain control of their startup.

Importance of Pre-Money and Post-Money Valuations for Startups

Pre-money and post-money valuations are crucial financial metrics that significantly influence investor decisions and startup strategies, as highlighted in the following sections:

- Understanding Ownership Percentage

Pre-money and post-money valuations play a crucial role in determining the percentage of ownership investors will hold in the startup. This ownership percentage directly impacts the level of control startup founders maintain over their business and the extent to which they must relinquish ownership to attract investors.

For example, if a startup’s pre-money valuation is $2 million and an investor injects $1 million through a SAFE agreement, the post-money valuation becomes $3 million. In this scenario, the investor would own one-third of the company ($1 million / $3 million), while the founders retain the remaining two-thirds.

- Evaluation of Financial Worth

Pre-money and post-money valuations offer a precise representation of the startup’s financial value, aiding investors in assessing the potential profitability of their investment. Overvaluation may discourage investors, while undervaluation might hinder the startup’s ability to secure necessary funding.

For instance, if a startup with promising technology overvalues itself at $10 million in the pre-money stage, investors may perceive it as unrealistic and may hesitate to invest. Conversely, if another startup undervalues itself at $1 million despite having a disruptive product, it may struggle to attract investors willing to provide the needed capital.

- Benchmark for Financial Growth

These valuations are benchmarks for startups to measure their financial growth and success. As startups evolve, their valuation will fluctuate, providing valuable insights into their progress and guiding strategic decisions for the future. Consider Slack, which had a pre-money valuation of $220 million in 2014. By 2017, after raising additional funding, its post-money valuation soared to $5.1 billion, reflecting a remarkable growth trajectory. Similarly, Uber experienced substantial growth, with a pre-money valuation of $4 million in 2010 soaring to a post-money valuation of $18.2 billion by 2014.

By comprehending pre-money & post-money valuations, startups can present a transparent and accurate portrayal of their financial status, thereby attracting the investment necessary for their growth and success.

Impact of Pre-Money and Post-Money Valuations on Startup Funding Rounds

The valuation of a startup before and after receiving funding can significantly influence its ability to secure future investment rounds. For instance, Uber had a pre-money valuation of $4 million in 2010, which surged to a post-money valuation of $18.2 billion in 2014. This drastic increase in valuation not only attracted more investors but also diluted the ownership percentage of existing shareholders. Conversely, a lower valuation might entice investors seeking higher returns but could indicate underlying struggles, making future funding rounds challenging.

- Importance of Strategic Investor Outreach

Successful fundraising requires a well-thought-out investor outreach plan. Understanding the nuances between pre-money and post-money valuations is essential for accurately presenting a startup’s financial standing to potential investors. Strategic communication and presentation of valuation metrics can positively influence investor perception and engagement.

- Determining Startup Valuation Across Different Stages

Valuing a startup at various lifecycle stages involves assessing several factors. In the seed stage, valuation relies on the team’s expertise, market potential, and the uniqueness of the product or service. For example, Snapchat had a pre-money valuation of $70 million in 2012, which soared to a post-money valuation of $25 billion in 2017, driven by its innovative social media platform. Revenue-generating startups’ valuation is based on financial indicators like revenue, profit, and growth rate. Early-stage startups’ valuation considers progress since the seed stage, such as product development and customer traction, while mature startups’ valuation emphasizes market opportunity and competitive positioning.

- Valuation Considerations and Collaboration

Market conditions, competition, and investor sentiment influence valuation. Startups should collaborate with experienced financial modeling consultants and investors to determine appropriate valuation methods aligned with their objectives. Avoiding common valuation mistakes enhances fundraising prospects and fosters long-term success.

Pre-money and post-money valuations play a pivotal role in securing funding for startups. Understanding these valuations is crucial for accurately portraying a startup’s financial position to investors. Collaboration with financial modeling consultants facilitates informed decision-making and enhances fundraising outcomes. By navigating valuation challenges strategically, startups can optimize their funding opportunities and achieve sustainable growth.

Examples of Successful Startups Leveraging Pre-Money and Post-Money Valuations

Successful startups have effectively utilized pre-money and post-money valuations to propel their growth. Here are some notable examples:

- Airbnb: Founded in 2008, Airbnb started with a modest pre-money valuation. However, by 2014, its post-money valuation had soared to $10 billion. This substantial increase in valuation allowed Airbnb to attract significant investments and expand its global presence, revolutionizing the hospitality industry.

- SpaceX: Established in 2002 by Elon Musk, SpaceX initially faced skepticism. However, with a pre-money valuation that steadily increased, reaching $33 billion in 2020, SpaceX demonstrated its potential in the aerospace industry. This remarkable valuation growth enabled SpaceX to secure lucrative contracts and pioneer advancements in space exploration.

- Slack: Beginning in 2014 with a pre-money valuation of $220 million, Slack’s valuation soared to $5.1 billion by 2017. This remarkable increase bolstered Slack’s ability to attract substantial funding, positioning it as a dominant force in the communication and collaboration landscape.

- Snapchat: In 2012, Snapchat boasted a pre-money valuation of $70 million. By 2017, this figure skyrocketed to a post-money valuation of $25 billion. This substantial increase enabled Snapchat to secure significant funding, establishing itself as a powerhouse in the social media sphere.

- Uber: In 2010, Uber entered the scene with a pre-money valuation of $4 million. By 2014, its post-money valuation surged to an impressive $18.2 billion. This remarkable valuation growth paved the way for Uber to secure substantial investments, solidifying its position as a leading player in the ride-hailing industry.

These startups adeptly utilized pre-money and post-money valuations to their advantage by accurately showcasing their business’s value to potential investors. By comprehending the nuances of these valuation methods and applying them effectively, startups can present a compelling case to investors and secure the necessary funding for sustained growth and success.

Avoiding Common Errors in Pre-Money and Post-Money Valuations

When it comes to calculating pre-money and post-money valuations, startups must steer clear of several common pitfalls. Here’s a rundown of the most frequent mistakes to sidestep:

- Misjudging Startup Value: Overvaluing or undervaluing a startup is a prevalent misstep. Overvaluation can deter potential investors, while undervaluation might lead to insufficient funding.

Suppose a startup sets its pre-money valuation at $10 million, but investor analysis suggests it should be closer to $5 million. Overvaluing the startup in this manner could deter investors who perceive the valuation as unrealistic.

- Neglecting Market Analysis: Failing to assess the market and competition can be detrimental. Startups should analyze market size and competitive landscape to determine a more accurate valuation and identify risks and opportunities.

Suppose a startup operates in a highly competitive market segment with slow growth prospects, but its valuation doesn’t reflect this reality. In that case, it may struggle to attract investors willing to pay the perceived premium.

- Disregarding Dilution Effects: Dilution, resulting from issuing new shares, can impact existing shareholders’ ownership percentage. Ignoring dilution’s impact can lead to inaccurate valuations and misaligned expectations.

A startup decides to issue additional shares worth $2 million in a funding round, diluting existing shareholders’ ownership by 20%. Failure to account for this dilution can lead to discrepancies between the expected and actual ownership stakes.

- Lack of Consistent Valuation Method: Consistency in valuation methods is key. Using different methods can yield inconsistent valuations, making it challenging to attract investors for future funding rounds.

If a startup alternates between using discounted cash flow and market multiple valuation methods, it may result in widely varying valuations that confuse potential investors and undermine their confidence in the startup’s financial stability.

- Over-Reliance on Projections: While projections are crucial, excessive reliance on them can be risky. Startups must ensure their projections are realistic and based on accurate data to avoid overvaluing and potential financial instability.

A startup forecasts exponential revenue growth based on optimistic assumptions about market demand and customer acquisition. However, if these projections fail to materialize, it could lead to financial strain and ultimately devalue the startup in the eyes of investors.

- Failure to Seek Professional Guidance: Not seeking advice from financial modeling consultants can be costly. Working with experienced professionals helps avoid common errors and ensures valuations are accurate and appealing to investors. A startup decides to calculate its valuation internally without consulting financial modeling experts. As a result, it overlooks crucial factors and ends up with an inaccurate valuation that hampers its fundraising efforts.

Benefits of Hiring a Financial Modeling Consultant for Startup Valuations (Including Pre & Post Money Valuations)

Startup valuations are complex and require a deep understanding of financial modeling. Financial modeling consultants can provide valuable insights and support to help startups accurately determine their pre-money and post-money valuations. Here are some of the benefits of hiring a financial modeling consultant for startup valuations:

- Expertise and Insight

Financial modeling consultants offer extensive experience and specialized knowledge in startup valuations. They provide valuable insights on accurately assessing pre-money and post-money valuations. Staying abreast of financial modeling techniques and industry best practices, consultants ensure startups receive precise advice tailored to their needs.

- Customized Solutions

Recognizing each startup’s uniqueness, financial modeling consultants provide tailored solutions to address specific challenges. Through collaboration, consultants understand the startup’s goals, crafting bespoke financial models that reflect its value proposition and growth potential.

- Objectivity and Accuracy

One advantage of working with financial modeling consultants is their impartial perspective. They help startups avoid overvaluation or undervaluation pitfalls by grounding valuations in inaccurate financial data. Consultants identify risks and opportunities, enabling informed decision-making aligned with strategic objectives.

- Enhanced Decision-Making

Accurate financial modeling is fundamental to sound decision-making in startups. Consultants furnish startups with comprehensive financial data and analysis, empowering strategic choices regarding fundraising and expansion.

- Expanded Funding Prospects

Precise startup valuations are pivotal in attracting investors and securing funding. Financial modeling consultants assist startups in calculating pre-money and post-money valuations with precision, increasing their appeal and bolstering their chances of obtaining funding.

In summary, enlisting financial modeling consultants for startup valuations offers numerous benefits. From leveraging expertise to delivering customized solutions, consultants play a vital role in helping startups navigate valuation complexities and achieve financial objectives.