For every ambitious firm, raising money is a crucial first step. However, there’s one last obstacle to overcome before the champagne toast: the term sheet. Getting the essential parameters of an investment correctly may make or break your company journey. This paper, despite its appearance of simplicity, describes them.

Term sheet modeling can help with it. It’s the skill of deciphering, evaluating, and negotiating the conditions specified in a possible funding arrangement. And to be honest, there are moments when it feels like trying to decode hieroglyphics. Here’s where we get involved!

With the help of this thorough guide, you will have all the information you need to successfully negotiate the term sheet maze. We’ll dissect the main clauses, provide you with the necessary forms, and give you helpful advice on how to read and negotiate like an expert. Together, we can uncover the keys to obtaining the appropriate funding for the rapid expansion of your firm!

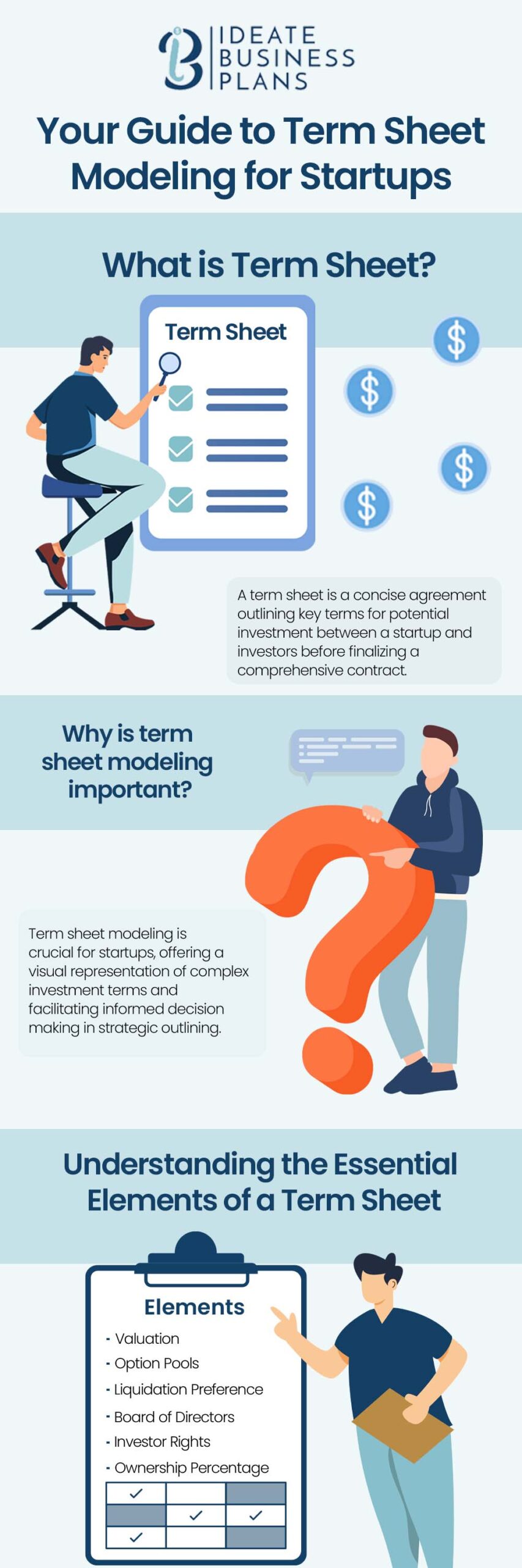

1.1 What is a Term Sheet?

A term sheet isn’t a legally binding contract but the precursor to your official investment agreement. Think of it as a handshake and high-level summary of the key deal points, covering everything from valuation and investment amount to governance rights and liquidation preferences. It serves as an outline for a possible business agreement between two parties. It is important to remember, though, that term sheets are flexible instruments that are useful in a variety of transactions, such as mergers and acquisitions. Term sheets indicate the terms and conditions under which an investor plans to complete a deal, much like letters of intent. Typically, investors looking to lead an equity round in the context of startups draft a term sheet and ask for your approval of the suggested parameters.

1.2 Structure of a term sheet

While wording their documents differently, lawyers typically create term sheets with a similar format. Although the format and language used might change according to the legal firm and the particular transaction, most term sheets include the same fundamental components.

To illustrate the common structure, let’s examine the format outlined in Alex Wilmerding’s book, “Term Sheets & Valuations.”

1. Introduction: This part typically mentions when the term sheet ends and explains the details of the exclusivity clause.

2. Initial Details: These paragraphs generally give an overview of the proposed transaction, naming the investor and the potential investee.

3. New Securities: This section outlines the type of securities the startup plans to issue (usually convertible preferred stock), the total capital to be raised, the number of shares, and the price per share.

4. Post-Financing Ownership: Here, you can find the ownership structure of the company after the financing round, including the shares allocated to major shareholders.

5. Investor Rights: This detailed section outlines the rights of the investors receiving the new securities, covering aspects like dividends, liquidation preferences, redemption rights, conversion rights, voting rights, protective provisions, and anti-dilution clauses.

6. Conditions: This part explains the due diligence to be carried out once the startup agrees to the term sheet.

7. Employee Matters: This section provides information about employee stock option programs, key person insurance, and the hiring of new executives. Investors often require an expansion of stock option plans and board approval for hiring key executives as part of their investment.

8. Closing Details: This section specifies the closing date, the startup’s legal representation, and who will cover the associated legal expenses.

1.3 Templates for Term Sheets

Discovering the appropriate term sheet template can make a significant impact. Here are some references to help you begin:

National Venture Capital Association (NVCA) Model Legal Documents: Presents diverse standardized templates, including a term sheet specifically designed for venture capital investments.

Sheets Startup: Supplies freely available, adaptable term sheet templates tailored for various funding stages.

VC Cafe: Gathers a valuable collection of authentic term sheet examples from various rounds and industries.

2. Why is term sheet modeling important?

Entering the critical space of startup funding, term sheet modeling becomes an essential step. This is using a well-crafted term sheet template to strategically map out the key components of an investment agreement through the use of a structured representation. This modeling technique makes it easier for startups to understand the complex information included in a term sheet by providing a straightforward representation of variables like as financing amounts, valuations, and investor rights. Using a well-crafted terms sheet template for fund subscription expedites this modeling process even further and gives companies a tactical tool for outlining and assessing various situations before signing contracts.

Startups discover that term sheet modeling greatly improves comprehension when learning how to read term sheets. Through the visual representation of intricate terms and conditions, entrepreneurs may more effectively evaluate the possible effects on their business. In addition to making a term sheet’s sometimes complex language easier to understand, the modeling approach gives startups the ability to recognize and understand a term sheet’s main themes. Additionally, term sheet modeling helps entrepreneurs understand the important elements in the term sheet and helps them make well-informed judgments.

Term sheet modeling shows up as a useful tool that may help entrepreneurs make sense of the complex world of startup finance by providing clarity and insight. Selecting the best startup capital advisor to lead this process is crucial since it will yield advantages like industry credibility and strategic insights, which will increase the benefits of taking a term sheet from a prestigious venture capital company.

2.1 Why is it important to negotiate the terms of a term sheet?

In business transactions, negotiating a term sheet is essential and has the power to make or break success. It is an initial, non-binding contract that outlines the conditions that have been agreed upon for a commercial transaction, setting the fundamental parameters and mutual expectations. It serves as a first agreement in principle and serves as a roadmap for further in-depth and legally binding talks.

To ensure that everyone involved receives a fair and advantageous contract, this negotiating process is essential. Achieving a common understanding is facilitated by taking into account the interests and possible problems of each side. Additionally, throughout negotiations, each party’s expectations are made clear, enabling talks on any possible issues before the transaction is finalized. Crucially, it offers a chance to negotiate advantageous terms and circumstances that might be difficult to achieve through direct contract discussions.

Negotiating a term sheet is essential for comprehension and clarity in addition to getting the best bargain. Before formally establishing any agreements, it aids parties in understanding their obligations and rights. This proactive strategy addresses issues early on, averting possible conflicts. Preliminary negotiations facilitate modifications and exchanges, resulting in a more advantageous conclusion for all parties.

3. Understanding the Essential Elements of a Term Sheet

A term sheet is a draft agreement that lists the important terms and conditions of a possible investment. To navigate these seas, one must have a thorough awareness of its essential components:

Valuation: Assessing business valuation is essential in evaluating pre- and post-money valuations to minimize founder dilution and unneeded performance pressure in term sheet modeling.

Option Pools: Plans for employee stock ownership (ESOPs) are essential. Because pre- and post-money option pools affect founder equity, founders need to be aware of them. Dilution must be balanced to get a fair bargain.

Liquidation Preference: By guaranteeing they would get back a portion of their investment in the case that the firm fails, this protects investors. It determines how payments are made to stakeholders during a liquidation event.

Board of Directors: Even though it may appear ordinary, board composition becomes important as a company grows. It is essential to strike a reasonable balance between the representation of investors and founders, including an independent member.

Investor Rights: It is critical to safeguard investors in their early phases. Different rights may apply, such as the right of first refusal, preemptive rights, and anti-dilution rights. A fair negotiation is ensured by legal advice.

Ownership Percentage: The term sheet outlines the power allocation and voting rights inside the company in this part, along with the ownership percentages of the various share classes. This is important, particularly when decisions about the company need to be voted on by shareholders.

Participation Rights: Early returns and a participation right to a portion of the remaining money are advantageous to investors. Founders may try to negotiate their exclusion.

Dividends: It is crucial to decide how earnings are allocated to shareholders. The financial relationships between investors and founders are impacted by cumulative and non-cumulative dividend systems.

3.1 Navigating Startup Success: A Founder’s Guide to Term Sheets

Starting a startup’s fundraising path frequently entails figuring out the complexities of a term sheet, a crucial document that molds the investment contract. Founders must be able to understand the essential components to guarantee a just and advantageous agreement. Here are six smart pointers to help you understand the procedure.

1. Assess the Price:

The company’s value is the main feature of any term sheet. The ownership percentage exchanged for the investment should be considered by the founders in relation to their financial requirements. Finding a balance guarantees sufficient cash for achieving important benchmarks without jeopardizing potential future funding sources.

2. Watch for Unusual Terms:

Economic words have become more similar due to standardization, however identifying off-market phrases might reveal an investor’s aggressiveness. Particularly from top-tier VCs (venture capitalists), features like cumulative dividends or non-standard liquidation preferences may indicate concern.

3. Beware of “Negative Control”:

For founders, retaining control is essential. Term sheets that provide investors “negative control” need founder consent before doing specific actions. It’s critical to strike a balance between founder flexibility and investor safety.

4. Understand VC Negotiation Approach:

Similar to courtship, the first round of negotiations offers a preview of the possible long-term partnership. Understanding how VCs negotiate may be gained by watching them. Future collaborations will benefit from collaborative talks, but a zero-sum mentality can cause problems.

5. Stick to Standard Terms:

Despite the fact that founders frequently welcome innovation, term sheet discussions may not be the best setting for nontraditional strategies. When normal terms are not followed, extra expenses and complications may result. Greater emphasis on company development is ensured by efficient fundraising.

6. Rely on Trusted Legal Support:

It needs professional advice to navigate the knowledge imbalance between VCs and entrepreneurs. Experienced legal counsel, familiar with innumerable term sheets, is a great asset. Their background helps entrepreneurs, particularly those starting out, make wise choices.

Conclusion:

Founders must become experts in modeling in the complex world of startup funding. A well-organized document, which is sometimes offered in the form of a flexible template, serves as a compass to help companies navigate the challenges of obtaining funding. In this trip, being able to read papers, comprehend their essential elements, and interpret their provisions become vital abilities.

Using a template to ensure accuracy and clarity in negotiations is a calculated step in fund subscription. A good adviser for startup funding acts as a compass, guiding business owners through the complexities of startup and assisting them in making well-informed decisions. Founders can deconstruct the process by adopting a basic company example and obtaining initial investment with a well-negotiated startup. Accepting from a prestigious venture capital firm offers advantages such as industry reputation and strategic insights in addition to cash access.

Startups are essentially more likely to succeed if they understand the meaning, go through instances of venture capital, and pay close attention to the details of the investment template. A well-written document becomes a founder’s ally as they navigate the wide seas of investor terms, resulting in fruitful partnerships and long-term success.