Introduction

Valuing a Startup plays a pivotal role in the capital-raising journey for startups, holding significant importance for entrepreneurs as they navigate the financial landscape.

Understanding Valuing a Startup isn’t just about numbers; rather, it’s about equipping founders with the tools to make informed decisions that shape the future of their ventures.

By comprehending the value of their startup, entrepreneurs can engage in meaningful discussions with investors, negotiate terms effectively, and safeguard the integrity of their business.

Valuing a Startup serves as a strategic compass, guiding entrepreneurs through the complexities of fundraising and empowering them to chart a course toward sustainable growth and success.

In essence, mastering Valuing a Startup isn’t merely a financial exercise; it’s a key driver in the entrepreneurial journey, enabling founders to articulate the worth of their vision and forge meaningful partnerships for the road ahead.

Understand the Basics of Valuation

What is Valuation?

Valuation, in the context of startup financing, refers to the process of determining the worth of a startup company. It involves assessing various factors such as the company’s potential for growth, its assets, revenue projections, market conditions, and comparable transactions in the industry.

Valuing a Startup accurately is crucial for both entrepreneurs and investors, as it sets the foundation for negotiating investment terms and understanding the potential returns on investment.

Importance of Valuing a Startup

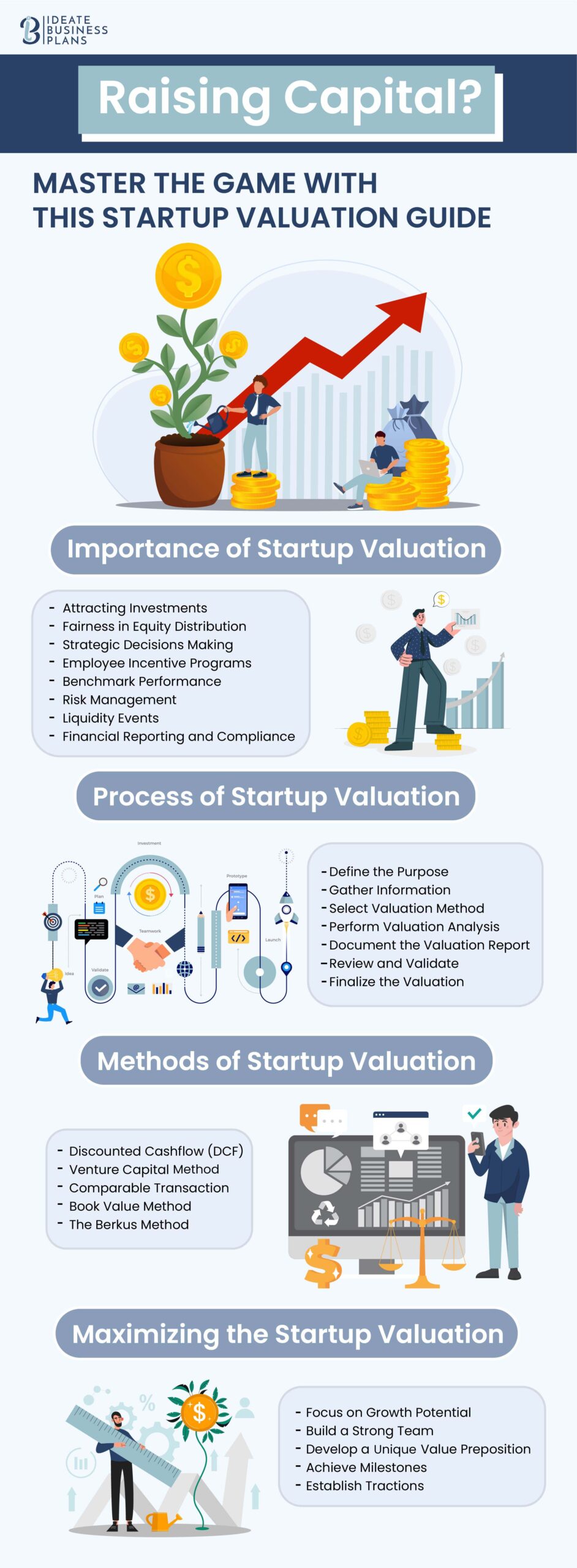

Valuing a Startup is crucial for several reasons:

1.Fundraising

Valuing a Startup serves as a benchmark for determining how much equity to offer investors in exchange for their capital. It helps entrepreneurs gauge how much their company is worth and how much ownership they are willing to trade for investment.

2.Strategic Decision-Making

Understanding the valuation of a startup informs strategic decisions regarding funding rounds, expansion plans, and potential exit strategies. It provides clarity on the company’s financial health and growth prospects.

3.Investor Confidence

A well-justified valuation can instill confidence in potential investors by demonstrating the startup’s potential for growth and profitability. It can also attract strategic partners who may be interested in collaborating or investing in the company.

Why Valuing a Startup Matters in Raising Capital?

Valuing a Startup plays a critical role in the fundraising process for startups:

1.Determining Investment Terms

Valuing a Startup directly impacts the terms of investment rounds, including the amount of equity offered to investors and the valuation cap for convertible instruments such as convertible notes or SAFEs (Simple Agreements for Future Equity).

2.Attracting Investors

A realistic valuation that aligns with the startup’s growth prospects can attract investors who perceive the investment opportunity as fair and promising. Conversely, an inflated valuation may deter potential investors or lead to unrealistic expectations.

3.Negotiation Dynamics:

Valuing a Startup sets the stage for negotiations between entrepreneurs and investors. Understanding valuation dynamics enables entrepreneurs to negotiate favorable terms while ensuring that the startup retains sufficient equity for future rounds and employee stock option pools.

Impact on Equity Distribution in Valuing a Startup

Valuing a Startup directly influences the distribution of equity among stakeholders:

1.Founder Equity Dilution

Higher valuations typically result in lower dilution for founders and early stakeholders when raising capital. Conversely, lower valuations may lead to significant equity dilution, potentially impacting founders’ control and ownership stakes in the company.

2.Investor Ownership

Valuing a Startup determines the percentage of equity that investors receive in exchange for their investment. Higher valuations imply lower ownership stakes for investors, whereas lower valuations may offer investors larger ownership shares at a lower cost.

Implications for Investor Negotiations

Understanding Valuing a Startup is essential for navigating investor negotiations effectively:

1. Justifying Valuing a Startup

Entrepreneurs must be able to justify their startup’s valuation based on factors such as market potential, revenue projections, competitive landscape, and the team’s expertise. Providing transparent and data-driven insights can strengthen their negotiating position.

2.Balancing Growth and Equity

Entrepreneurs should strike a balance between raising capital to fuel growth and preserving equity ownership in the company. Negotiating fair valuation terms ensures that both parties, entrepreneurs, and investors benefit from the investment partnership.

How To Do Startup Valuation?

Various methods of Valuing a Startup are employed by venture capitalists, and they can differ from one business to another.

Discounted Cash Flow Method (DCF)

The Discounted Cash Flow (DCF) Method estimates the present value of a startup’s future cash flows. It requires making projections about the startup’s revenue, expenses, and cash flows over a certain period. Subsequently, discounting those cash flows back to their present value using a discount rate is essential.

Formula

The Formula for DCF is:

DCF = CF1(1+r)1+CF2(1+r)2+CFn(1+r) n

Where:

CF1 = The Cash Flow for Year One

CF2 = The Cash Flow for Year Two

CFn = The Cash Flow for Additional Years

r = The Discount Rate

Example

Here’s an example of a Discounted Cash Flow (DCF) valuation method applied to a hypothetical company:

Let’s consider a fictional company called XYZ Corporation, which operates in the software industry and is expected to generate cash flows for the next five years. We’ll assume the following:

- Cash Flow Projection: We project the cash flows for the next five years.

- Terminal Value: After the projection period (in this case, five years), we estimate the terminal value of the company.

- Discount Rate (Cost of Capital): We determine the discount rate, also known as the weighted average cost of capital (WACC), which represents the required rate of return for investors.

Let’s go through the steps of DCF valuation for XYZ Corporation:

Cash Flow (CF)

| Year | Cash Flow (CF) |

| Year 1 | $5 million |

| Year 2 | $6 million |

| Year 3 | $7 million |

| Year 4 | $8 million |

| Year 5 | $9 million |

Terminal Value

For simplicity, let’s assume the terminal value is calculated using the perpetuity growth method. We estimate that the company will continue to grow at a constant rate of 3% beyond the fifth year.

Terminal Value = Year 5 Cash Flow * (1 + Growth Rate) / (Discount Rate – Growth Rate)

= $9 million * (1 + 3%) / (10% – 3%)

= $132 million

Discount Rate (WACC)

Let’s assume the WACC for XYZ Corporation is 10%.

We discount the projected cash flows and the terminal value back to their present value using the discount rate.

Present Value (PV) = CF / (1 + Discount Rate)^n

| Year | Cash Flow | Discount Factor (10%) | Present Value (NPV) |

| 1 | $5 million | 1.000 | $5 million |

| 2 | $6 million | 0.909 | $5.454 million |

| 3 | $7 million | 0.826 | $5.782 million |

| 4 | $8 million | 0.751 | $6.008 million |

| 5 | $9 million | 0.683 | $6.147 million |

| Terminal Value | $132 million | 0.386 | $48.576 million |

Sums of Present Values

Sum of Present Values = $5 million + $5.454 million + $5.782 million + $6.008 million + $6.147 million + $48.576 million => $71.967 million

Intrinsic Value

The intrinsic value of XYZ Corporation, based on the DCF valuation, is $71.967 million.

This valuation provides an estimate of the company’s worth based on its expected future cash flows and the discount rate applied to those cash flows.

Venture Capital Method in Valuing a Startup

The Venture Capital Method is commonly used by venture capitalists to value startups based on their expected future returns. It involves estimating the startup’s terminal value at the end of a specified investment horizon. Subsequently, discounting that value back to the present using a required rate of return is essential.

The Venture Capital Valuation Method is a simple way to estimate the value of an early-stage startup company. It is often used by venture capitalists to evaluate investment opportunities. Here’s an example of how the method works:

Example

Let’s assume a startup named ABC:

| Current annual revenue | $500,000 |

| Projected growth rate | 50% per year |

| Venture capital firm’s holding period | 5 years |

| Venture capital firm’s desired return rate | 30% |

| Investment amount | $1,000,000 |

Using the Venture Capital Valuation Method, we can estimate ABC’s pre-money valuation and post-money valuation:

Pre-money valuation

This is the value of the company before receiving investment.

Pre-money valuation = Projected revenue in the exit year / (1 + Desired return rate) ^ Holding period

Pre-money valuation = $500,000 * (1 + 0.30) ^ 5 = $1,856,465

Post-money valuation

This is the value of the company after receiving investment.

Post-money valuation = Pre-money valuation + Investment amount

Post-money valuation = $1,856,465 + $1,000,000 = $2,856,465

So, according to the Venture Capital Valuation Method, ABC’s pre-money valuation is approximately $1,856,465 and its post-money valuation, after the venture capital investment, is $2,856,465.

Pros & Cons

This method provides a simple way for venture capitalists and startup founders to estimate the value of the company and negotiate investment terms.

However, it’s important to note that this method has its limitations and may not capture the full value of the startup, especially in cases where the startup’s potential for growth and market dynamics are not accurately reflected in the financial projections.

Comparable Transaction Method

Valuing a startup using the Comparable Transaction Method involves analyzing the valuation metrics of similar companies in the same industry that have recently been bought or sold.

This method relies on comparing key financial metrics such as revenue, profit, growth rate, and market share. Adjustments are made to the valuation based on differences between the target company and the comparable companies.

Example

For instance, let’s consider a startup named “XYZ” specializing in software development and seeking a valuation using the Comparable Transaction Method. To determine XYZ’s value, we would look at recent transactions involving similar software development companies. By examining these transactions, we can derive insights into market trends, pricing multiples, and overall valuation benchmarks within the industry.

Ultimately, the Comparable Transaction Method offers a structured framework for valuing startups based on real-world transactions, providing stakeholders with insights to support informed decision-making and investment strategies.

- Identify Comparable Transactions

- Select Key Metrics

- Calculate Valuation Metrics (Enterprise Value (EV) to Revenue, EV to EBITDA, or Price to Earnings (P/E) ratio.)

- Apply Valuation Metrics to XYZ

- Adjust for Differences

- Determine Final Valuation

- Consider Other Factors

| Annual Revenue | $5 million |

| Comparable Transaction Median EV/Revenue Multiple | 2.5x |

| Implied Valuation | $12.5 million |

Through the Comparable Transaction Method, XYZ could be valued at approximately $12.5 million based on the multiples derived from similar transactions in the industry.

Book Value Method in Valuing a Startup

The Book Value Method calculates the value of a startup based on its net assets, which include tangible assets such as equipment, property, and inventory, as well as intangible assets like patents and trademarks.

However, this method does not consider the startup’s potential for future earnings or growth.

The Book Value valuation method is a straightforward approach used to determine the value of a company based on its recorded assets and liabilities on its balance sheet.

Example

Here’s a simplified example:

Let’s say we have a fictional company called ABC Corporation. Here’s a snapshot of its balance sheet:

| Total Assets | $500,000 |

| Total Liabilities | $200,000 |

| Shareholders’ Equity | $300,000 |

To calculate the book value per share, we divide the total shareholders’ equity by the number of outstanding shares. Let’s assume ABC Corporation has 10,000 outstanding shares.

Book Value per Share = Shareholders’ Equity / Number of Outstanding Shares

Book Value per Share = $300,000 / 10,000 = $30 per share

In this example, the book value per share of ABC Corporation is $30.

Now, let’s say an investor wants to determine the total value of ABC Corporation using the Book Value valuation method. The investor multiplies the book value per share by the total number of outstanding shares.

Total Value of ABC Corporation = Book Value per Share * Number of Outstanding Shares

Total Value of ABC Corporation = $30 * 10,000 = $300,000

So, according to the Book Value valuation method, the total value of ABC Corporation is $300,000.

Pros & Cons

Valuing a startup involves assessing its worth using various methods, including the Book Value method. The Book Value method offers a simple estimate of a company’s value by considering the historical cost of assets and liabilities on the balance sheet.

However, it may not reflect the true market value or potential earnings, especially in dynamic startup environments where asset and liability values can significantly differ.

Investors often combine the Book Value method with other valuation techniques like the Comparable Transaction Method, Discounted Cash Flow analysis, or Market Approach.

These methods consider factors such as revenue potential, growth prospects, and industry benchmarks to provide a more comprehensive evaluation.

By using multiple valuation approaches, investors can better understand a startup’s financial health, growth potential, and attractiveness as an investment opportunity.

The Berkus Method

The Berkus Method, devised by venture capitalist Dave Berkus, is a simplified approach used primarily for early-stage startups.

It assigns a range of values to specific achievements or milestones reached by the startup. These milestones typically include areas such as prototype development, management team formation, strategic partnerships, and market validation.

Each milestone is assigned a predetermined value, and the total valuation is calculated by summing up these values.

The Berkus Method is a straightforward valuation approach often used for early-stage startups. It assesses the value of a company based on specific milestones achieved by the startup.

Example

Here’s a simplified example of how the Berkus Method might be applied:

Let’s consider a startup named “XYZ Innovation” that is in its early stages of development. The Berkus Method evaluates the company’s value based on five key milestones:

- Basic Value

- Prototype Value

- Quality Management Team

- Strategic Partnerships or Product Rollout

- High Revenue Growth or Key Product Launch

Let’s apply the Berkus Method to XYZ.:

| Basic Value | $250,000 |

| Prototype Value | $500,000 |

| Quality Management Team | $750,000 |

| Strategic Partnerships or Product Rollout | $1,000,000 |

| High Revenue Growth or Key Product Launch | $1,500,000 |

XYZ has achieved a basic prototype and assembled a quality management team. However, it hasn’t yet formed strategic partnerships or experienced high revenue growth.

Based on the Berkus Method, the valuation of XYZ might be estimated at $750,000, reflecting the achieved milestones.

Pros & Cons

The Berkus Method provides a structured approach to valuing early-stage startups, considering tangible milestones rather than relying solely on financial projections or market comparables.

However, it’s important to note that the actual valuation may vary based on the startup’s specific circumstances, market conditions, and growth potential.

Tips for Maximizing Valuation in Startup

Focus on Growth and Traction in Startup Valuation

Demonstrating revenue growth and market traction is essential. Presenting clear evidence of increasing sales figures, expanding customer base, and positive feedback from early adopters can significantly enhance valuation prospects.

Metrics such as monthly recurring revenue (MRR), customer acquisition cost (CAC), and customer lifetime value (CLV) can showcase the scalability and sustainability of the business model.

Build a Strong Team and Advisory Board

Highlighting the expertise and credibility of the team is crucial for instilling investor confidence. Emphasizing the track record and relevant experience of key team members in driving successful ventures or relevant industries is essential.

Additionally, showcasing the caliber of advisors who are supporting the company can add further validation and strategic guidance, augmenting the perceived value of the startup.

Develop a Compelling Story and Vision for your Startup!

Crafting a narrative that resonates with investors and stakeholders is paramount. A compelling story should articulate the problem the startup is addressing, the uniqueness of its solution, and the potential impact it can make in the market.

Aligning the company’s vision with broader industry trends and societal needs can evoke investor enthusiasm and support, driving valuation upwards.

Negotiation Strategies in Valuing a Startup

Employing effective negotiation strategies is essential for securing favorable valuation terms while maintaining investor interest. It’s important to conduct thorough market research to understand comparable valuations within the industry and leverage this information during negotiations.

Additionally, focusing on the long-term partnership and growth potential can help foster a collaborative negotiation environment. Being transparent about the company’s strengths and areas for improvement while remaining firm on valuation principles can lead to mutually beneficial outcomes.

Key Takeaways from the Startup Valuation Guide

- Understanding Valuation’s Significance on Startups:

Valuation isn’t just about numbers; it’s about empowering entrepreneurs to make informed decisions, engage with investors effectively, and shape the future of their ventures strategically.

- Valuation’s Role in Fundraising for Startups:

Valuation is crucial for determining investment terms, attracting investors, and facilitating negotiations. It serves as a benchmark for equity distribution and influences investor confidence in the startup’s growth potential.

- Methods of Startup Valuation:

Various valuation methods, including the Discounted Cash Flow, Venture Capital, Comparable Transaction, Book Value, and Berkus methods, offer different approaches to assessing a startup’s worth based on factors like cash flows, industry comparables, asset values, and achieved milestones.

- Maximizing Valuation:

To maximize valuation, startups should focus on demonstrating growth and traction, building a strong team and advisory board, developing a compelling story and vision, and employing effective negotiation strategies. These efforts can enhance investor confidence and support.

- Negotiation and Strategic Decision-Making in Valuing a Startup:

Effective negotiation strategies, transparent communication, and a focus on long-term growth potential are essential for securing favorable valuation terms while maintaining investor interest. Entrepreneurs should be prepared to walk away from deals that undervalue their startup’s potential or compromise strategic objectives.